Mortgage calculator 10 year fixed rate

A 10-year fixed mortgage is a home loan thats paid within a period of 10 years. 30 Year Fixed 6375.

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Get a better mortgage rate.

. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. The initial period can be three years 31 five years 51 seven years 71 or ten years 101. However for those who can afford the slightly higher payment associated with a 10-year mortgage are getting a better deal in almost every possible way.

There could also be additional costs to factor in depending on why you want. If you take out a 30-year fixed rate mortgage this means. 30-Year Mortgages and Extra Payments.

If you prefer predictable steady monthly payments a 30-year fixed. Now that you have your estimated home price check out different loan options with our Mortgage Calculator. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

Year-to-date business profit and loss statement for current year if more than three months. Filters enable you to change the loan amount duration or loan type. Refinance to a fixed-rate mortgage.

After years of making regular payments the amount paid in interest begins to stack up and can become one of the more burdensome costs associated with mortgages. Mortgage type The mortgage type includes the term of the mortgage between 1-10 years and the rate type variable or fixed. How much money could you save.

The rate will change annually according to the market after the initial period. Shop around for the best mortgage rate you can find and consider using a mortgage broker to negotiate on your behalf. Advantages of a 10-Year Fixed-Rate Home Loan.

30 Year Fixed. Understanding How 10-Year Fixed Mortgages Work. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

To find out if a 10-year mortgage is right for you do the math using the Bankrate Mortgage Calculator. We offer a wide range of loan options beyond the scope of this calculator which is designed to provide results for the. Your monthly payment stays the same for the entire loan term.

Thinking of getting a 30-year variable rate loan with a 10-year introductory fixed rate. Unlike mortgage rate surveys our index is driven by real-time changes in actual lender rate sheets. Here are some of the advantages of a 10-year mortgage over.

See todays 30-year mortgage rates. Get the latest interest rates for 10-year fixed-rate mortgages. The MND Rate Index is the best way to follow day-to-day movement in mortgage rates.

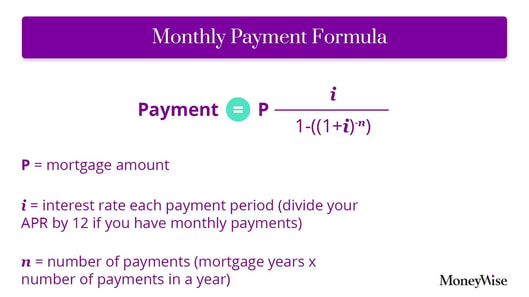

Fixed-Rate Mortgage Calculator. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

20 Year Fixed 6125. APR Calculator for Adjustable Rate Mortgages. Compare lenders serving Redmond to find the best loan to fit your needs lock in low rates today.

Home affordability estimate and monthly payment are based on a 30-year fixed-rate mortgage on a single-family residence with an interest rate of interestRate apr on aprDate for a borrower with excellent credit and. Leaving a Fixed Rate Mortgage Early is possible but you may face an early exit mortgage fee. With a Fixed Rate Mortgage the interest rate and the principal and interest payment will remain the same throughout the life of the loan.

So a 51. 15 Year Fixed 5125. Use our mortgage calculator to estimate the cost of different loan types and compare interest paid for a 15-year mortgage and a 30-year mortgage.

By default 250000 30-yr fixed-rate loans are displayed in the table below. Well also compare payments between 10-year 15-year and 30-year fixed-rate mortgages. 10YR Adjustable Rate Mortgage Calculator.

It will also save you thousands of dollars over the life of your mortgage. A lower mortgage rate will result in lower monthly payments increasing how much you can afford. Its popularity is due to low monthly payments and upfront costs.

A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float. So as a general rule two-year fixes are cheaper to sever early than mortgages with five-year fixes or higher. You may be surprised to see how much you can save in interest by getting a 15-year fixed-rate mortgage.

Use this calculator to figure your expected initial monthly payments the expected payments after the loans reset period. If the monthly payments are too high on a 10-year or 15-year term refinancing to a 20-year fixed-rate mortgage would also cut down your payments and potentially to a more affordable level. N 30 years x 12 months per year or 360 payments.

The big advantage of a 30-year home loan over a 10-year loan is a lower monthly payment. This home loan has relatively low monthly payments that stay the same over the 30-year period compared to higher payments on shorter term loans like a 15-year fixed-rate mortgage. Use this calculator for basic calculations of common loan types such as mortgages auto loans student loans or personal loans.

Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate. Mortgage insurance typically costs 05 185 percent of your loan amount per year billed monthly though it can go higher or lower depending on your credit score. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan.

One year ARMs used to be the standard but the market has now produced ARMs called hybrids which combine a longer fixed period with an adjustable period. A mortgage in itself is not a debt it is the lenders security for a debt. If you have an escrow account for taxes andor insurance the escrow portion of your monthly payment may vary.

Be sure to check back. Most homebuyers in America tend to obtain 30-year fixed-rate mortgagesAs of June 2020 the Urban Institute reports that 30-year fixed-rate loans account for 77 percent of new mortgages in the market. Using our mortgage rate calculator with PMI taxes and insurance.

Read our Guide to find out how a specialist broker can help. For example a 100000 30-year fixed mortgage might come with an interest rate of 3 requiring the borrower to pay an additional 3 on top of their principal loan balance. Mortgage rates valid as of 31 Aug 2022 0919 am.

Because its a fixed-rate mortgage FRM it maintains the same interest rate for the entire loan duration. Paying Back a Fixed Amount Periodically. Lock-in Redmonds Low 30-Year Mortgage Rates Today.

The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. Free loan calculator to find the repayment plan interest cost and amortization schedule of conventional amortized loans deferred payment loans and bonds. A 30-year fixed-rate mortgage is by far the most popular home loan type and for good reason.

The mortgage term is the length of time you commit to the terms conditions and mortgage rate with a specific lender. Or call us.

Mortgage Amortization Calculator Amortization Schedule Mortgage Amortization Calculator Loan Calculator

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

Mortgage Calculator Canada Moneywise

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

Online Mortgage Calculator Wolfram Alpha

Compare 30 Vs 15 Year Mortgage Calculator Mls Mortgage Mortgage Calculator Amortization Schedule Mortgage Rates

Georges Excel Mortgage Loan Calculator V3 1 Digital Download Single User License

Mortgage Points Calculator Mls Mortgage Amortization Schedule Mortgage Calculator Mortgage

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Mortgage Tips

Home Mortgage Calculator Templates 13 Free Docs Xlsx Pdf Mortgage Payoff Pay Off Mortgage Early Mortgage Amortization Calculator

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Calculator With Principal Interest Taxes Insurance Pmi Piti Hoa Fees Mortgage Amortization Calculator Mortgage Calculator Mortgage Payment Calculator

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Payoff

The Top 3 Ontario S Mortgage Calculators To Look Out In 2021 Mortgage Lenders Mortgage Calculators

Types Of Home Loans Infographic Fha Conventional Va Usda Purchase Refinance Fixed Rate And Real Estate Buyers Real Estate Infographic Real Estate Tips

All Trumped Out On Twitter Real Estate Tips Real Estate Infographic Real Estate News